Accounting

Accounting expertise is essential in every industry, offering stable, high-value career opportunities.

Enjoy an Education Grant

of S$1,090 when you enrol2

Accounting

Accounting

Enjoy an Education Grant

of S$1,090 when you enrol2

Accounting is an integral part of the management process in any organisation. Effective accounting practices enable the evaluation of operational efficiency and overall performance. The information produced through accounting supports informed decision-making for a wide range of purposes, including acquiring or selling shares, lending money, and offering goods or services on credit.

Accounting also plays a key role in helping managers, owners, and investors safeguard an organisation’s assets and investments. Data generated through accounting processes is essential for guiding capital investments and shaping strategic business decisions.

Top 5 Reasons to Choose Murdoch University

- Double Majors. Double the Advantage.

Gain in-depth expertise across two specialisations and stand out in today’s competitive job market. - Complete Your Double Major Degree

in 16 months1

Advance your education and step into your career with a strong competitive advantage. - Flexible Study Schedule3

Plan your own timetable and study at your own pace — perfect for busy learners. - Access Classes Anytime, Anywhere

Enjoy the convenience of recorded lectures and online learning resources available 24/7. - Full Degree Transcript Upon Completion

Upon completion, you will receive a full Degree transcript — a globally recognised record of achievement that reflects all the modules. This serves as your official proof of academic excellence, supporting your career advancement and further study opportunities.

Single & Double Majors Available

- Bachelor of Business in Accounting

- Bachelor of Business in Accounting and Banking

- Bachelor of Business in Accounting and Finance

- Bachelor of Business in Accounting and Human Resources Management

- Bachelor of Business in Accounting and International Business

- Bachelor of Business in Accounting and Management

- Bachelor of Business in Accounting and Marketing

- Bachelor of Business in Accounting and FinTech

Industry-Relevant Units

This Degree consists of 12 units (with exemptions) or 16 units. The following units are covered in the programme:

- Accounting Theory and Accountability

- Auditing

- Company Law

- Contemporary Financial Accounting

- Corporate Finance

- Management Accounting

- Taxation

- Technology and Accounting Processes

- Building Employability Skills or Consulting and Freelancing

- Career Learning: Managing Your Career4

- Elective unit

- Elective unit

Duration & Intakes

Duration: 16 months1

Intakes: January, May & August

Accreditation & Ranking

- Top 2% Universities Worldwide5

- The College of Business is an AACSB Business Education Alliance Member

- 5-star rating for Overall and Teaching, Employability, Innovation and Inclusiveness

Professional Accreditations

- Accredited with the Accounting and Corporate Regulatory Authority (ACRA)6

Receive exemptions for up to 5 modules with the Singapore Chartered Accountant Qualification (SCAQ) Foundation Programme. Foundation Programme module exemption fees are waived for candidates with Accredited Degrees. - Accredited with the Association of Chartered Certified Accountants (ACCA)6

Receive exemptions for up to 9 exams (3 Applied Knowledge and 6 Applied Skills exams) - Accredited with the Certified Public Accountant (CPA) Australia6

Direct entry into CPA programmes - Accredited with Australia and Chartered Accountants Australia and New Zealand (CAANZ)

Professional Memberships

- Member of the Institute of Public Accountants (IPA)

- Associate member of the Institute of Singapore Chartered Accountants (ISCA)7

Overview of the Accounting Industry

in Singapore

The Accounting industry in Singapore plays a critical role in upholding financial integrity, regulatory compliance, and business confidence. As a global financial hub, Singapore relies heavily on high-quality audit, tax, and advisory services to support both multinational corporations and fast-growing local enterprises.

In recent years, the industry has continued to expand. Growth was driven by sustained demand for audit and assurance services, followed by corporate support services, business advisory services, and tax advisory and compliance services.

In-Demand Skill Sets

As the digital and green economies continue to expand, accounting firms are increasingly focused on strengthening their teams’ digital and sustainability-related expertise.

Their primary investment areas include advanced data analytics and data visualisation, followed by emerging capabilities in sustainability assurance, sustainability reporting, risk management, and governance skills.

These priorities signal a strategic shift toward data-driven decision-making and the development of stronger Environmental, Social, and Governance (ESG) competencies across the profession8.

Key Players: The Big 4

The market is dominated by the Big 4 accounting firms and continue to account for about 70% of the Accounting sector’s total revenue9.

- Deloitte

- PricewaterhouseCoopers (PwC)

- Ernst & Young (EY)

- KPMG

Their extensive service portfolios spanning audit, tax, risk advisory, digital consulting, and ESG services set the pace for industry trends and capability development.

What You Will Learn

- Apply accounting and professional accounting knowledge in professional and practical contexts.

- Demonstrate knowledge of accounting and professional accounting and exhibit effective communication and interpersonal skills.

- Display the capability to think across cultures and contexts, and to engage in lifelong learning.

- Evaluate accounting and professional accounting issues and problems, develop evidence‐based conclusions, and integrate knowledge of ethical issues into professional practice.

Tuition Fee

The total tuition fee covers university registration, lectures/tutorials/workshops, and main assessments such as assignments/tests/examinations/projects (where applicable), programme materials in digital format, Degree (if earned), and transcript.

S$22,105.20 inclusive of GST, payable in 4 instalments

(12 units with exemptions)

S$29,473.60 inclusive of GST, payable in 4 instalments

(16 units)

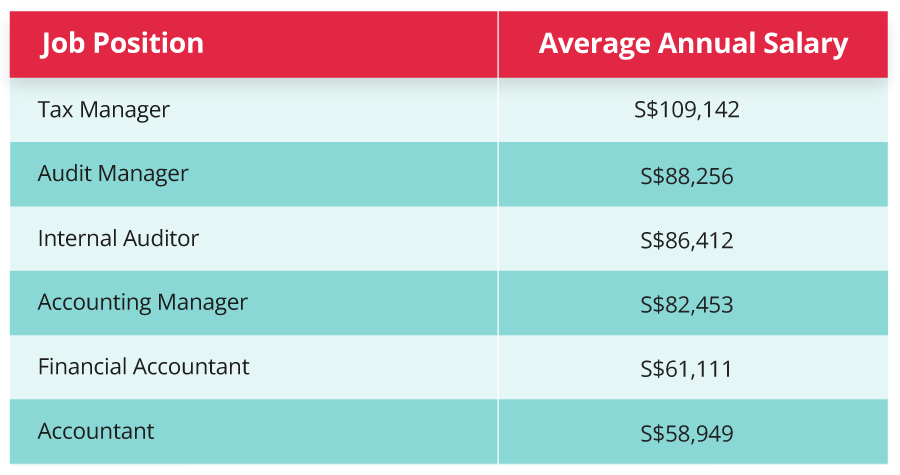

Career Opportunities & Salary Guide

A qualification or background in accounting opens doors to a diverse range of rewarding career pathways across multiple service areas. Depending on your strengths and professional interests, you can develop expertise in roles that support organisational growth, ensure regulatory compliance, and contribute to long-term strategic success. These opportunities include roles in areas such as:

- Audit & Assurance – Evaluating financial statements, assessing internal controls, and providing independent assurance to stakeholders on the accuracy and reliability of financial reporting.

- Business Advisory – Offering insights and strategic guidance to improve business performance, streamline operations, and support decision-making across various industries.

- Corporate Support – Contributing to essential organisational functions, including financial management, budgeting, governance, and operational efficiency.

- Tax Advisory & Compliance – Advising individuals and organisations on tax-efficient strategies, ensuring compliance with tax laws, and helping manage tax-related risks.

- Sustainability Reporting, Advisory & Assurance – Supporting organisations in developing sustainability strategies, reporting on ESG performance, and providing assurance over non-financial disclosures.

These pathways allow you to build a dynamic and impactful career, with opportunities to work across sectors, specialise in niche areas, and contribute meaningfully to the success and integrity of businesses and communities.

Source: Indeed (accurate as of January 2026)

Enquire Now

Contact Our Consultant

Marlina, Senior Manager

Email: [email protected]

WhatsApp: 9856 6884

Refer Your Friend

Do you have a friend who is looking to advance their career? Share your study experience and encourage them to take the next step in their professional development.

They can gain access to quality education, and you will be rewarded for helping them achieve their career aspirations.

For every friend you refer who successfully enrols, you will receive a S$1,000 Referral Incentive10. There is no limit – the more you refer, the more you earn!

- Applicants with a Polytechnic Diploma may be exempted from up to 12 units and can gain entry to Year 2 of the programme. Applicants with a Murdoch University-recognised Kaplan Diploma or a private Diploma may be exempted from up to 8 units and can also gain entry to Year 2 of the programme. Instead of 28 to 36 months, depending on the programme/major chosen and if students follow the recommended study plan

- Applicable to 2026 intakes (Education Grant Terms & Conditions)

- Programme duration may be extended for students who take a lesser study load each term

- 3-year Polytechnic Diploma holders are exempted, subject to University’s approval.

- Murdoch University. QS World University Rankings 2026 & Webometrics

- Exemptions granted will be subject to accrediting professional bodies’ sole discretion at any time.

- Associate membership is available to applicants who have completed an Accounting Degree or an equivalent Accounting qualification. Applicable to Bachelor of Business in Accounting (Single Major), Accounting & Business Law (Double Major) and Accounting & Finance (Double Major).

- ACRA Accounting Entities Survey 2025

- The Business Times article dated 12 November 2025

- Terms and conditions apply

Accreditations remain subject to accreditation providers. Kaplan Higher Education Academy is not responsible for any changes in accreditation requirements or loss of accreditation status not attributable to

Kaplan Higher Education Academy.

The information on this website is correct as of January 2026.