Fintech

Demand for skilled professionals capable of integrating finance with technology.

Enjoy an Education Grant

of S$1,090 when you enrol2

FinTech

FinTech

Enjoy an Education Grant

of S$1,090 when you enrol2

A Degree in Fintech addresses the ongoing digital transformation of the Financial sector, equipping you with the expertise to innovate and apply data analytics in areas such as algorithmic trading, digital banking, and financial risk assessment. Developed in collaboration with industry partners, the programme emphasises effective communication and the ability to design solutions for complex, real-world IT challenges. It prepares you to meet the evolving demands of technology-driven finance with confidence and agility.

Top 5 Reasons to Choose Murdoch University

- Double Majors. Double the Advantage.

Gain in-depth expertise across two specialisations and stand out in today’s competitive job market. - Complete Your Double Major Degree

in 16 months1

Advance your education and step into your career with a strong competitive advantage. - Flexible Study Schedule3

Plan your own timetable and study at your own pace — perfect for busy learners. - Access Classes Anytime, Anywhere

Enjoy the convenience of recorded lectures and online learning resources available 24/7. - Full Degree Transcript Upon Completion

Upon completion, you will receive a full Degree transcript — a globally recognised record of achievement that reflects all the modules. This serves as your official proof of academic excellence, supporting your career advancement and further study opportunities.

Single & Double Majors Available

- Bachelor of Business in Accounting and FinTech

- Bachelor of Business in Banking and FinTech

- Bachelor of Business in Finance and FinTech

- Bachelor of Data Analytics in FinTech

- Bachelor of Data Analytics in FinTech and Business Information Systems

- Bachelor of Data Analytics in Data Science and FinTech

- Bachelor of Data Analytics in FinTech and Cyber Security and Forensics

- Bachelor of Data Analytics in FinTech and Data Science

- Bachelor of Information Technology in Artificial Intelligence and Autonomous Systems and FinTech

- Bachelor of Information Technology in Business Information Systems and FinTech

- Bachelor of Information Technology in Computer Science and FinTech

- Bachelor of Information Technology in Cyber Security and Forensics and FinTech

Industry-Relevant Units

This Degree consists of 14 units (with exemptions) or 16 units. The following units are covered in the programme:

- Applied Statistics

- Big Data and Data Science

- Business Analytics

- Commercial Banking

- Corporate Finance

- Databases

- Information Security Policy and Governance

- Intelligent Systems

- Introduction to ICT Research Methods

- Machine Learning

- Principles of Computer Science

- Security Architectures and Controls

- Statistical Data Analysis

- The Search for Everything: Data Analytics

and Storytelling

in the 21st Century

Duration & Intakes

Duration: 16 months1

Intakes: January, May & August

Accreditation & Ranking

- Top 2% Universities Worldwide4

- The College of Business is an AACSB Business Education Alliance Member

- 5-star rating for Overall and Teaching, Employability, Innovation and Inclusiveness

Overview of the Fintech Industry in Singapore

Singapore has established itself as one of the leading Fintech hubs in Asia, driven by strong government support, robust financial regulations, and a highly developed digital infrastructure. The Monetary Authority of Singapore (MAS) continues to promote innovation through initiatives such as the FinTech Regulatory Sandbox and the Singapore FinTech Festival, fostering collaboration between start-ups, financial institutions, and technology firms.

The Fintech ecosystem spans a wide range of services, including blockchain applications, digital lending, digital payments, insurtech, regulatory technology, and wealth technology. Emerging technologies such as artificial intelligence, blockchain, and data analytics are reshaping how financial services are delivered, enabling greater efficiency, inclusion, and personalisation.

As digital transformation accelerates, the demand for skilled professionals capable of integrating finance with technology continues to rise. Fintech companies and financial institutions alike are seeking talent who can develop innovative solutions, manage data-driven insights, and navigate evolving regulatory landscapes, making the sector one of the most dynamic and opportunity-rich in Singapore’s economy.

Demand for Professionals in the Fintech Sector

The rapid growth of Fintech has created strong and sustained demand for skilled professionals in Singapore. Employers are particularly seeking individuals who can bridge finance and technology — those proficient in coding, data analytics, cyber security, and regulatory compliance.

Fintech firms, along with banks and digital finance institutions, are hiring across functions such as data science, product management, risk analysis, and software development.

As digital transformation accelerates across the Financial sector, demand for Fintech talent is expected to remain robust.

What You Will Learn

- Build an understanding of ethical, security, regulatory, and global considerations essential to the adoption of financial technology within the financial sector.

- Develop the ability to use quantitative and qualitative techniques to analyse emerging trends in the financial industry and make informed corporate financial decisions.

- Gain the skills to evaluate and assess fintech solutions, trade-offs, and risks in response to changing market conditions.

- Learn to apply financial data, analytical methods, and statistical tools using specialised software and professional presentations.

Tuition Fee

The total tuition fee covers university registration, lectures/tutorials/workshops, and main assessments such as assignments/tests/examinations/projects (where applicable), programme materials in digital format, Degree (if earned) and transcript.

Bachelor of Data Analytics in FinTech (Single Major)

S$26,399.80 inclusive of GST, payable in 4 instalments

(14 units with exemptions)

S$29,081.20 inclusive of GST, payable in 4 instalments

(16 units)

(Nett programme fee listed above = Tuition fee of S$30,171.20 minus Education Grant of S$1,0902)

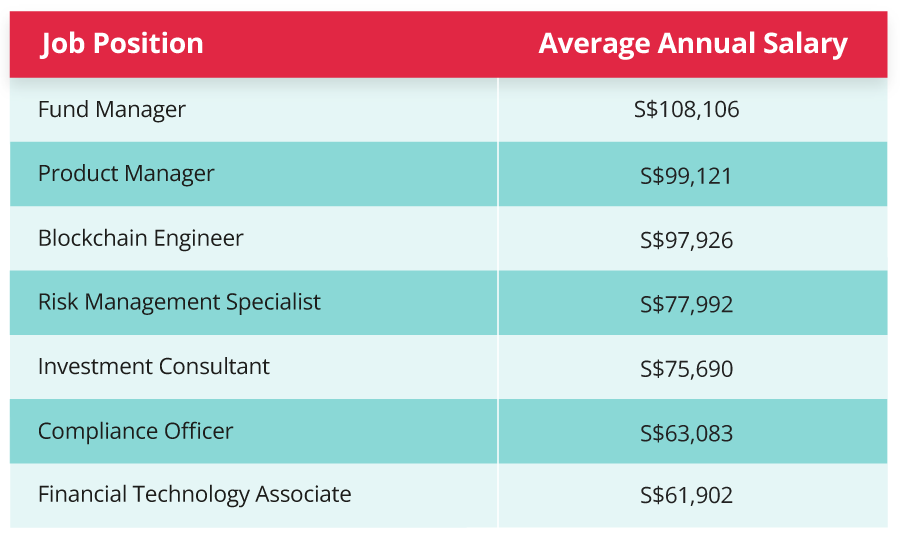

Career Opportunities & Salary Guide

Professionals who combine technical skills with financial understanding and an innovative mindset are well-positioned for success. Their skills are also transferable to adjacent fields like E-commerce, Finance, and Sustainable Digital Consulting.

As demand for Fintech expertise continues to rise, the industry offers extensive opportunities for professional growth, making it one of the most dynamic and rewarding fields in the modern economy.

Source: Indeed (accurate as of February 2026)

Enquire Now

Contact Our Consultant

Carmen Chen, Assistant Manager

Email: [email protected]

WhatsApp: 9663 9569

Refer Your Friend

Do you have a friend who is looking to advance their career? Share your study experience and encourage them to take the next step in their professional development.

They can gain access to quality education, and you will be rewarded for helping them achieve their career aspirations.

For every friend you refer who successfully enrols, you will receive a S$1,000 Referral Incentive5. There is no limit – the more you refer, the more you earn!

- Applicants with a Polytechnic Diploma may be exempted from up to 12 units and can gain entry to Year 2 of the programme. Applicants with a Murdoch University-recognised Kaplan Diploma or a private Diploma may be exempted from up to 8 units and can also gain entry to Year 2 of the programme. Instead of 28 to 36 months, depending on the programme/major chosen and if students follow the recommended study plan

- Applicable to 2026 intakes (Education Grant Terms & Conditions)

- Programme duration may be extended for students who take a lesser study load each term

- Murdoch University. QS World University Rankings 2026 & Webometrics

- Terms and conditions apply

Accreditations remain subject to accreditation providers. Kaplan Higher Education Academy is not responsible for any changes in accreditation requirements or loss of accreditation status not attributable to

Kaplan Higher Education Academy.

The information on this website is correct as of December 2025.